Warren Buffett’s decades at Berkshire Hathaway’s helm have provided invaluable investment lessons that remain particularly relevant today. Following his recent retirement announcement, revisiting his core principles offers guidance through today’s market conditions.

“Be fearful when others are greedy, and greedy when others are fearful” remains one of Buffett’s most insightful observations. April’s market turbulence, driven by concerns about tariffs, inflation, and interest rates, created potential opportunities for investors who maintained perspective beyond short-term fluctuations.

Despite recent market recovery, valuations remain more favorable than they were earlier this year. This environment presents possibilities for disciplined investors who, like Buffett, can look beyond temporary volatility to focus on long-term objectives.

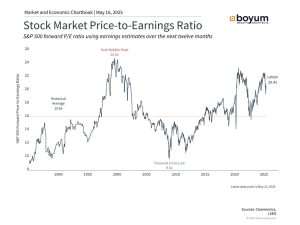

Recent volatility has created more attractive valuations

“Whether we’re talking about stocks or socks, I like buying quality merchandise when it is marked down.” – Warren Buffett, 2018 Berkshire Hathaway annual letter

Buffett consistently advocates investing in undervalued companies. The recent market pullback combined with steady earnings growth has brought S&P 500 price-to-earnings ratios to approximately 20x, aligning with decade-long averages. While short-term concerns triggered this valuation reset, it potentially signals new opportunities.

Over longer timeframes, valuation metrics provide the most reliable gauge of market attractiveness. Daily market movements often respond to headlines and specific events, but these typically fade in significance over time. What ultimately matters more is whether investors initially paid reasonable prices for assets with solid growth potential.

Valuation indicators help determine investment value beyond mere price – examining earnings, book value, cash flow, and dividends. Historically, purchasing assets at attractive valuations improves prospects for stronger future returns, showing a consistent correlation with long-term performance.

Earnings continue their upward trajectory

“Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on.” – Warren Buffett, 2013 Berkshire Hathaway annual letter

Beyond improved pricing, corporate earnings growth has contributed significantly to better valuations. With most S&P 500 companies having reported first-quarter results, earnings have grown 12.8%, substantially exceeding initial expectations of 7.2%. Communication Services, Financials, Healthcare, and Information Technology sectors have led this growth, while Consumer sectors have shown relative weakness.

Company earnings calls have revealed three key themes: a cautious approach to tariff uncertainties, continued commitment to capital investments (particularly in technology and AI infrastructure), and ongoing strategic transformations to adapt to changing economic conditions.

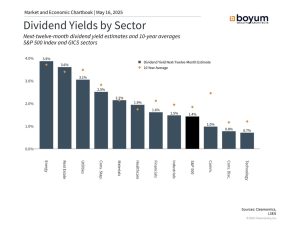

Dividend growth strengthens investor returns

“It’s not good news when any company cuts its dividend dramatically” – Warren Buffett, 2023 Berkshire Hathaway annual meeting

While Berkshire Hathaway rarely distributes dividends, Buffett has benefited substantially from the dividend payments of his portfolio companies. His mentor Benjamin Graham emphasized dividends as crucial indicators of financial health. Despite market uncertainty, dividends have maintained their upward trajectory, with many sectors offering yields near their 10-year averages.

For income-focused investors, dividends provide essential portfolio yield. Companies typically maintain dividend payments except during serious financial strain, making them reliable signals of corporate health. Continued dividend growth suggests management confidence despite near-term uncertainties.

The bottom line? Warren Buffett’s career demonstrates that patient, long-term investing remains the most effective approach during market uncertainty. These principles are especially valuable now as fundamental indicators continue to improve.

If you have any questions or would like to discuss further, please reach out to a member of the Boyum Wealth Architects team.