We have rounded third and are headed for home, as October marks the start of the final quarter of 2025. The third quarter was again fruitful for investment markets, the S&P 500 gained 7.8%, the Bloomberg U.S. Aggregate Bond Index advanced 2.0% and emerging markets stocks continued their 2025 runup, growing by 10.1% in just the past three months.

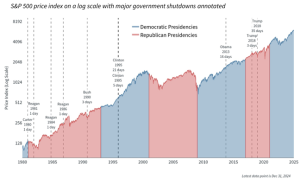

Top on many investors’ minds as we opened the quarter is the country’s most recent federal government shutdown. On an annual basis, the federal government must pass a budget for the next fiscal year, which begins on October 1. While the government passed the “One Big Beautiful Bill Act” earlier this year that lays out tax and spending policies, a budget is needed to allocate the actual dollars to different departments and agencies. Failure to do so by the deadline means that the government might face a shutdown, resulting in a lapse in government services and employees being furloughed.

Sources: Clearnomics, Congressional Budget Office.

Fortunately, as the accompanying chart demonstrates, while political drama in Washington can create uncertainty, history shows that government shutdowns typically have limited impact on financial markets. Government shutdowns may dominate headlines, create challenges for federal workers, and disrupt important services, but they have historically had minimal impact on financial markets.

Another market-related event occurring in just the past few weeks is that the Federal Reserve cut interest rates by 0.25% for the first time in nine months, now targeting a base rate range of 4.00% to 4.25%. They indicated a desire to support a weakening job market as well as counteracting the impact of tariffs on the economy. Markets are pricing in additional interest rate reductions, which means the elevated rates on money market funds many have come to enjoy are likely to decline over the next several months—there is currently a record $7.3 trillion held in money market funds.

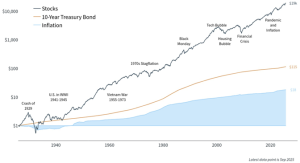

For investors who may hold more cash than is necessary or appropriate for their goals, now might be a good time to look elsewhere for their “excess cash.” The history of financial markets is clear when it comes to growing the value of hard-earned savings and beating inflation. As shown in the chart below, stocks and bonds have risen magnitudes more than inflation. Even though what used to cost $1 in 1926 now costs $18 today, stocks and bonds have risen many multiples more, creating true wealth for those who were positioned for these long trends. This is true despite periodic market pullbacks, financial crises, and recessions over the past century.

Sources: Clearnomics, Robert Shiller, Standard & Poor’s, BLS.

The bottom line? While cash serves important purposes, holding too much creates hidden costs. For long-term investors, maintaining an appropriate cash buffer while staying invested in long-term portfolios is still the best way to achieve financial goals.

As always, we encourage your feedback and questions on these topics or any others related to the success of your financial plan, email us at info@boyumwa.com or give us a call at 651-289-6444 if there are topics you would like to discuss.

This has been provided for informational purposes only, reflecting the current opinion of the author, which is subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.