Federal funding debates have returned to the forefront as lawmakers work to prevent a government shutdown. This development comes amid broader policy discussions affecting markets, including trade agreements, fiscal policy, and regulatory changes.

Many investors question how political developments might influence their investments. While concerns about fiscal policy and national debt are understandable, examining historical data reveals important patterns that can help maintain perspective during political uncertainty.

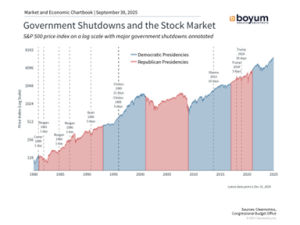

Historical data shows limited market impact from shutdowns

Federal budget negotiations occur annually, with fiscal years beginning October 1. Despite comprehensive legislation addressing spending priorities, appropriations must still be allocated to departments and agencies. When this process isn’t completed by the deadline, government operations may be affected and certain employees furloughed.

Meeting budget deadlines has proven challenging throughout recent decades. Congress has successfully passed appropriations before fiscal year deadlines only occasionally over the past fifty years. Continuing resolutions—temporary funding measures—have become standard practice while negotiations continue. Currently, a seven-week stopgap proposal is under consideration.

Since 1980, shutdowns have occurred under multiple administrations with various durations, yet financial markets have shown resilience. Even extended disruptions, including a 35-day period in 2018-2019, did not produce lasting market consequences. This pattern suggests such events represent temporary interruptions rather than fundamental economic challenges.

Current negotiations center on spending priorities

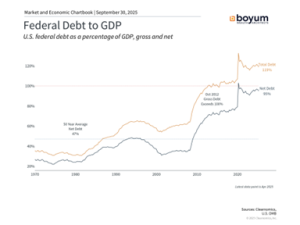

Today’s budget discussions primarily involve healthcare spending and broader fiscal policy questions. With federal debt around 120% of GDP, fiscal responsibility remains a priority, though approaches differ significantly.

The current situation differs somewhat from past episodes due to potential workforce reduction plans beyond typical temporary measures. It’s worth noting that furloughed workers receive back pay once operations resume, a policy established during previous negotiations.

Economic fundamentals drive market performance

Despite fiscal policy concerns, shutdowns have historically proven uneventful for markets because they represent temporary disruptions without altering underlying economic conditions. While they may delay economic data releases or create modest near-term headwinds if prolonged, these effects have not significantly impacted long-term investment outcomes.

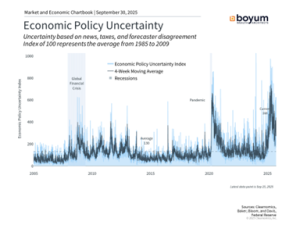

As shown in the Economic Policy Uncertainty chart, various policy developments earlier this year created volatility. However, with greater clarity emerging, uncertainty measures have declined toward historical averages. Past experience indicates even extended disruptions have not materially affected investment performance.

The bottom line? While government shutdowns attract attention and create real challenges for those affected, historical evidence shows minimal lasting impact on financial markets. Investors benefit from maintaining focus on long-term financial objectives rather than short-term political developments.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.